Tag Archives: Liquidity

Financial statement analysis paper 2023 Best

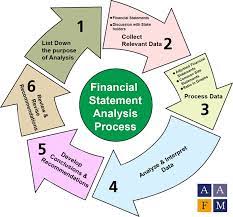

In this financial statement analysis paper we will discuss the financial health of these companies with the ultimate goal of making a recommendation to other investors.

Financial statement analysis paper

Financial Statement Analysis Final Paper – discuss the financial health of these companies with the ultimate goal of making a recommendation to other investors. Write a five- to seven-page comparative financial statement analysis of the three companies listed below, formatted according to APA style as outlined in the UAGC Writing Center. In this analysis, you will discuss the financial health of these companies with the ultimate goal of making a recommendation to other investors. Your paper should consist of the following sections: Company Overview, Comparison of Accounting Methods, Ratio Analysis, Final Recommendation, Conclusions.

Financial statement analysis paper

You will also submit an appendix as a separate document. Additional research may be necessary to provide company background information, or to support your analysis and recommendations. Your paper needs to include a minimum of two scholarly, peer-reviewed, and/or credible resources in addition to the textbook as references. Download the Form 10-K for each company. The Coca-Cola Company: Form 10-K Links to an external site. – Financial statements and notes start on page 60. Accounts receivable, page 81 Inventories, page 82 Depreciation, page 96 Goodwill, page 83 Keurig Dr Pepper Annual Report Links to an external site.

Financial statement analysis paper

Click on the 2018 Annual Report Accounts receivable, page 72 Inventories, page 72 Depreciation, page 73 Goodwill, page 74 PepsiCo Annual Report Links to an external site.- Financial statements and notes start on page 79. Accounts receivable, page 124 Inventories, page 89 Depreciation, page 95 Goodwill, page 88 Here is a breakdown of the sections within the body of the assignment (Use paragraph headings to indicate each section): Company Overview Provide a brief overview of the three companies (at least two pages). What industry is it in? What are its main products or services? Who are its competitors?

Financial statement analysis paper

Where is the company located? Ratio Analysis Calculate the current ratio, quick ratio, gross profit percentage, inventory turnover, accounts receivable turnover and asset turnover ratios for all three companies for the current year. Note: Cash includes cash and cash equivalents and short term investments. Explain how the ratio is calculated and discuss and interpret the ratios that you calculated. Discuss potential liquidity issues based on your calculations of the current and quick ratios. Are there any factors that could be erroneously influencing the results of the ratios? Discuss liquidity issues of the three companies.

Financial statement analysis paper

Comparison of Accounting Methods In your paper, ascertain from the notes of the financial statements the following: Explain the difference between the allowance method and the direct write off method for accounts receivable. Document the method used for each of the three companies. Explain the difference between the straight line, double declining balance and the unit-of-production depreciation methods. Document the method used for each of the three companies. Explain the difference between LIFO and FIFO and document the method used for each of the three companies. Explain the different categories of intangible assets and document the method used for each of the three companies.

Financial statement analysis paper

Recommendation Based on your analysis, would you recommend an individual invest in these companies? What strengths do you see? What risks do you see? It is perfectly acceptable to state that you would recommend avoiding this company, as long as you provide support for your position. Conclusions Include an appendix in a separate document. The appendix must include screenshots of the financial statements and information obtained for the receivables, intangible assets, depreciation, and inventory.

Financial statement analysis paper

You can get help with creating an appendix in APA format by using the UAGC Writing Center’s guide, Tables, Images, & Appendices Links to an external site.. The Financial Statement Analysis Final Paper Must be five to seven double-spaced pages in length (not including title and references pages) and formatted according to APA style as outlined in the UAGC Writing Center’s APA Style.Links to an external site. Must include a separate title page with the following: Title of paper Student’s name. https://youtu.be/qZmQZDQIc2Y

Attached Files

|

Financial analysis of apple company. 2022 Best

For this assignment we will an in depth financial analysis of apple company. There is clearly some disagreement regarding the financial situation of Apple (AAPL).

Financial analysis of apple company.

Assignment Minor BUSINESS MANAGEMENT Module 2: There is clearly some disagreement regarding the financial situation of Apple (AAPL). Consequently, a more in-depth analysis (over the last 5 years) is called for. 1) Executive summary: Review and select the most important facts and figures about Apple, which, in your opinion, will enable a reasonably educated person to understand in which financial position Apple is right now. Perform the same for Apple’s earnings situation.

Financial analysis of apple company.

Provide evidence for any and all claims you make. 2) Profitability review: a. How is Apple performing right now? Would you say that Apple is earning adequate profits? Why or why not? b. Has Apple’s profitability changed over the last years? Why or why not? Which metric do think is most meaningful for this purpose? Why? 3) Liquidity review: a. How is the liquidity of Apple right now? Would you say that Apple is liquid enough / too liquid? Why or why not? b. Has Apple’s liquidity changed over the last years? Why or why not?

Financial analysis of apple company.

Which metric do think is most meaningful for this purpose? Why? 4) Capital structure review: a. Provide an overview of Apple’s current capital structure and additionally identify anything out of the ordinary. b. Analyze all material (!) changes in Apple’s capital structure over the last 5 years. c. If you were Apple’s financial advisor, what would you recommend? 5) Dividend policy review: a. Provide an overview of Apple’s dividend policy of the last 5 years. 6) Risk review: a. Find out Apple’s CAPM beta coefficient and provide an interpretation.

Financial analysis of apple company.

b. Compare Apple’s CAPM efficient to the beta of its main competitor and explain in detail: i. how you selected the main competitor ii. Which of the 2 firms is the riskier investment in your opinion? Why? iii. Which of the 2 firms is the better investment in your opinion? Why? General information: • Prepare a report addressing all points outlined above. A longer report is not automatically better. Make it only as long as necessary to describe and answer comprehensively, but as short as possible.

Financial analysis of apple company.

Your final report should be organized and presented as if you’d’ hand it in to an important stakeholder. Pay attention to the structure, readability, layout (typos!) and any diagrams you might use. • Your report must contain a bibliography and must make use of correct referencing. • Your final report does not have to (but may) contain all calculations you performed. You must, however, hand in an xls with all your calculations – make sure your xls file is understandable by third parties as well! Be prepared to be able to explain what you have calculated. https://youtu.be/Q9aPsWa8McY

Attached Files

|

+1 650 405 4067

+1 650 405 4067