Tag Archives: Walmart versus Target

financial ratios and measures 2022 Best

Task: Select two competing companies from the same industry, calculate their financial ratios and measures (see below) based on their 2021 financial statements, and discuss from an investor’s point of view which of the two companies you would rather invest in.

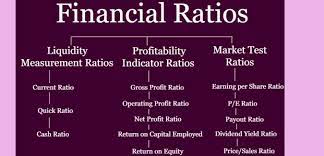

Financial ratios and measures

Task: Select two competing companies from the same industry, calculate their financial ratios and measures (see below) based on their 2021 financial statements, and discuss from an investor’s point of view which of the two companies you would rather invest in. Briefly explain your decision. Possible companies (select one): 1) Coca-Cola versus Pepsi 2) Walmart versus Target 3) Ford versus General Motors 4) Alphabet (Google) versus Meta (Facebook) Structure of the Assignment: – Briefly describe the two companies and their industry. – Calculate the following financial ratios/measures for both companies (you may include more ratios if you like):

Financial ratios and measures

1) Return on Equity 2) Return on Assets 3) Profit Margin Ratio 4) Current Ratio 5) Quick (Acid-Test) Ratio 6) Debt-to-Equity Ratio 7) Cash Flow from Operations to Total Liabilities Ratio – Discuss why you would rather invest in one company over the other from an investor’s point of view. Refer to the ratios/measures that you calculated. You may also include information and opinions about other factors (e.g., non-financial factors, CSR, market information) that influence your decision. The executive summary should be approximately 1 to 2 pages long (without the financial ratios table). Format of Paper: – Font size 12 – Single-spaced (ratios can be shown in single-spaced or table format)

Financial ratios and measures

Font type: Times New Roman How to retrieve Financial Statements/Financial Information: – There are several sources to get information about a company’s financial statements. It is up to you which website you use. Here is one possible website: o Go to: www.Finance.Yahoo.com o At the top of the webpage, insert the company name next to the “Search” button. Then, click on “Search.” o You are now on the “Summary” screen. This page already contains some relevant financial information. o On the top of the screen is a header called “Financials.” In that column, you can find the “Income Statement,” “Balance Sheet,” and “Cash Flows.” Additional relevant information is available under “Statistics.” https://youtu.be/o_deiuZnCls

Attached Files

|

+1 650 405 4067

+1 650 405 4067