Tag Archives: financial risk

Corporate finance strategy 2023 Best

The aim of this paper is to recommend a corporate finance strategy to enhance the value of an organization Student Success Criteria View the grading rubric for this deliverable by selecting the “This item is graded with a rubric” link, which is located in the Details & Information pane.

Corporate finance strategy

Deliverable 3 Fitbit Call Center Case. Paper instructions: Competency Recommend a corporate finance strategy to enhance the value of an organization Student Success Criteria View the grading rubric for this deliverable by selecting the “This item is graded with a rubric” link, which is located in the Details & Information pane. Scenario Fitbit has been around since 2007. Complaints are on the rise as the customer service department is outsourced and only consists of a chat feature. Sales have started to decline as bad reviews increase. One of the suggestions to boost sales and retain existing customers was to bring customer service back in house.

Corporate finance strategy

This creates the need for a $2 million-dollar call center to house 60 call, chat, and email agents. You are the financial manager and therefore must review the capital structure strategy for this project, review all the financial risk associated with the project, and analyze the budget to decide if the organization will accept or reject the proposed project. Instructions In Microsoft Word, write a recommendation that addresses the following: Discuss Fitbit’s organizational structure from production to current customer service.

Corporate finance strategy

Explore all the financial risk associated with this project Analyze the provided financial statements for budgeting and savings methods Recommend project be accepted or rejected with detailed reasoning NOTE – Be sure the recommendation displays proper grammar, spelling, punctuation, and sentence structure. https://youtu.be/SKxpUkPD_7o

Attached Files

|

Budgeted Income statement 2022 Best

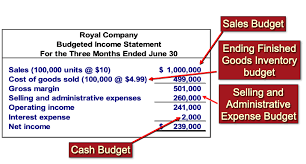

The aim of this this paper is to complete a Budgeted Income statement that shows if the company will be in an excellent position to afford this project over the next quarter. Scenario: During your career as an IT manager, you will be asked to conduct analyses to make well-reasoned financial decisions.

Budgeted Income statement

INTRODUCTION During your career as an IT manager, you will be asked to conduct analyses to make well-reasoned financial decisions. It is important that you are able to not only complete an analysis but also communicate and provide support for your decisions to a chief executive officer (CEO) and board of directors. Your financial decisions will need to align with the mission and strategic goals of the company. Your responsibilities will likely include determining the budgets for the IT department, making financial decisions about IT projects and enhancements, and managing the procurement of technology resources.

Budgeted Income statement

For Task 1 of this assessment, you will propose a new project that shows all the signs of propelling the company forward. You will then have to complete a Budgeted Income statement that shows if the company will be in an excellent position to afford this project over the next quarter. Then you will have to factor in the funding, financial risk, and profitability of your project to successfully pitch your idea. To start, you will choose a publicly traded company from the list provided in the scenario. Once you have chosen a company, you will download the company’s recent quarterly financials (10-Q) from the SEC EDGAR Company Filings web link.

Budgeted Income statement

You will also need to read the attached “Financial Fact Sheet” for the company you choose. The “Financial Fact Sheet” for each company mirrors the Securities and Exchange Commission (SEC) guidelines for formatting the numbers. Each number in the fact sheets could be in millions, thousands, or dollars depending on the company’s 10-Q report. This fact sheet will provide you with the company’s strategic goals and the information you will need to determine any project budgets. You will select one strategic goal for your chosen company and decide on an IT project that aligns with that goal.

Budgeted Income statement

Your IT investment project idea must include a software component or a software as a service (SaaS) solution and be based on the information provided in the company’s “Financial Fact Sheet” regarding the initial cost of the project. At this point, you will be able to create an IT project analysis and proposal report that describes the company’s financial position, determines the budgets related to the project, and outlines how you will fund your idea for the IT investment project. The skills you showcase in completing this report will be useful in your career when conducting analyses and making financial decisions.

Budgeted Income statement

This report may also be added to your portfolio to show to future employers. SCENARIO You are the chief information officer (CIO) of one of the following publicly traded companies: A. Home Depot (ticker symbol: HD) B. Big 5 (ticker symbol: BGFV) C. Build-A-Bear (ticker symbol: BBW) You’ve been asked to propose a capital project for IT that includes a software component that will propel the company forward. As part of your responsibilities, the CEO has asked you to review the company’s financial statements and analyze the budget and cash flow for the IT department.

Budgeted Income statement

Since the budget for Capital Expenditure projects has already been allocated, you will need to get the CEO and the board of directors to agree to spend more than they initially intended. Your project must not only be compelling but also show how the company’s 10-Q reports their profits or losses, as this may be a roadblock to moving forward. REQUIREMENTS Your submission must be your original work. No more than a combined total of 30% of the submission and no more than a 10% match to any one individual source can be directly quoted or closely paraphrased from sources, even if cited correctly. https://youtu.be/DYg2jT9aUG4

Attached Files

|

+1 650 405 4067

+1 650 405 4067