Closing journal entries. 2022 Best

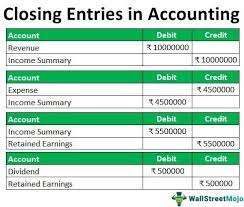

For the accounting assignment we will focus on closing journal entries. Scenario: It is the last day of the month and fiscal year, your manager asks you to create an invoice for $10,000 (debiting Accounts Receivable and Crediting Sales) and send it to a specified customer.

Closing journal entries.

Paper details: It is the last day of the month and fiscal year, your manager asks you to create an invoice for $10,000 (debiting Accounts Receivable and Crediting Sales) and send it to a specified customer. Normally invoices are sent to customers when products have been shipped or the service has been finished. You manager tells you that we will be shipping equipment and performing the setup services for this customer next month (as early as next week). You know that by preparing the closing entries tomorrow, the revenue will be included in this year’s fiscal year and then the revenue account will be set to zero for the beginning of the year.

Closing journal entries.

What is your manager trying to accomplish by asking you to do this? How would you respond to your manager? Do you have any suggestions or alternative ways you would recommend to your manager on how to record this? How would the company’s financial statements (and the users of the financial statements) be affected if you record this entry? What are the four closing journal entries? Why are these necessary? https://youtu.be/CXiKLtb7tqI

Attached Files

|

+1 650 405 4067

+1 650 405 4067