Tag Archives: fiscal year

Radio enhancement initiative 2022 Best

Paper details: You have been assigned to manage a new radio enhancement initiative in your department. The fire chief has indicated that he would like to accomplish the following goals: upgrade radios from Motorola to BK,

Radio enhancement initiative

Paper details: You have been assigned to manage a new radio enhancement initiative in your department. The fire chief has indicated that he would like to accomplish the following goals: upgrade radios from Motorola to BK, ensure each person has their own radio (68 personnel), install a mobile data device (MDT) on each apparatus (eight), and upgrade all eight mobile apparatus radios. Funding for this enhancement will come from the operations budget that will already be reduced by 25% in the next fiscal year (FY).

Radio enhancement initiative

Plan for startup costs and any other additional costs that may be incurred in that FY. Use the (attached-excell) Anywhere Fire Department Operations Budget document, and modify it to complete the budget portion of the assignment. develop a report to the fire chief. The components below should be included. Include an introduction. Provide an overview of the project the fire chief gave you, and discuss various types of budgeting methods that can be used. Discuss the operational budget with a 25% cut. Elaborate on the impact of the budget cuts.

Radio enhancement initiative

Provide strategies for good budget planning to gain budget approval. Include the status of the radio initiative, including operating costs in future years for the radio line items. Discuss your recommendations and strategies for budget approval. Your paper should be a minimum of two pages in length, not counting the budget attachment page. You must use at least two references. Please adhere to APA Style when creating citations and references for this assignment.https://youtu.be/cFRxisTYWI4

Attached Files

|

Closing journal entries. 2022 Best

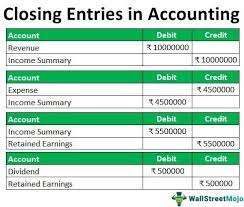

For the accounting assignment we will focus on closing journal entries. Scenario: It is the last day of the month and fiscal year, your manager asks you to create an invoice for $10,000 (debiting Accounts Receivable and Crediting Sales) and send it to a specified customer.

Closing journal entries.

Paper details: It is the last day of the month and fiscal year, your manager asks you to create an invoice for $10,000 (debiting Accounts Receivable and Crediting Sales) and send it to a specified customer. Normally invoices are sent to customers when products have been shipped or the service has been finished. You manager tells you that we will be shipping equipment and performing the setup services for this customer next month (as early as next week). You know that by preparing the closing entries tomorrow, the revenue will be included in this year’s fiscal year and then the revenue account will be set to zero for the beginning of the year.

Closing journal entries.

What is your manager trying to accomplish by asking you to do this? How would you respond to your manager? Do you have any suggestions or alternative ways you would recommend to your manager on how to record this? How would the company’s financial statements (and the users of the financial statements) be affected if you record this entry? What are the four closing journal entries? Why are these necessary? https://youtu.be/CXiKLtb7tqI

Attached Files

|

+1 650 405 4067

+1 650 405 4067